Elevating Risk Management in a Volatile Yet Resilient Market (Part 1)

By David Poms

2023 brought with it a sense that change was inevitable. The writing on the wall was clear—insurance costs were on the rise, and the looming possibility of continued commercial premium increases into 2024 and beyond. Commercial insurance brokers and their clients found themselves in a relentless pursuit of strategies to navigate this challenging hard market.

While some economic forecasts hinted at a potential softening in the near future, the exact timeline for this shift remained uncertain. In simple terms, business owners were advised to brace themselves for higher insurance costs in the near future.

However, amidst these challenges, the age-old saying, “every crisis is an opportunity”, resonated strongly in today’s commercial insurance landscape. The decisions businesses make today regarding risk management resources will significantly impact their bottom line in the foreseeable future.

As we approach 2024, it is becoming evident that this year will be foundational for commercial insurers and reinsurers. Poms & Associates envisions 2024 as a year in which smart insurance and business risk management will emerge as key competitive advantages. Businesses that embrace this “new normal” can not only contain insurance costs but also fortify their overall resilience.

Insurers and Reinsurers Directing Focus on Profitability

Let’s take a step back and look at the bigger picture. Several key indicators tell us that 2024 will not be a mere repetition of 2023:

- Maturing Technologies: Technologies continue to evolve, enhancing insurers’ and reinsurers’ operational and economic efficiency.

- Economic Stability Post-Pandemic: The post-pandemic era is marked by overall economic stability, characterized by falling inflation and “priced-in” disruption.

- Appetite for Catastrophe Risk: Tentative signs point to carriers’ increased appetite for natural catastrophe risk as catastrophe capacity comes back online (...or maybe not).

While the focus on profitability has shareholders and investors smiling, it’s crucial to understand that today’s emphasis is less about stakeholder ROI and more about building a robust defense against disruption. This includes intensifying and emerging risks such as natural catastrophe, cyber threats, social inflation, geopolitical unrest, and a slower economic recovery for major markets outside the US.

Stabilized inflation rates and increased business efficiency from continued investment in Insurtech and AI have tempered some assumptions. Reading between the lines, there’s even cautious optimism about the insurance industry and the economy at large.

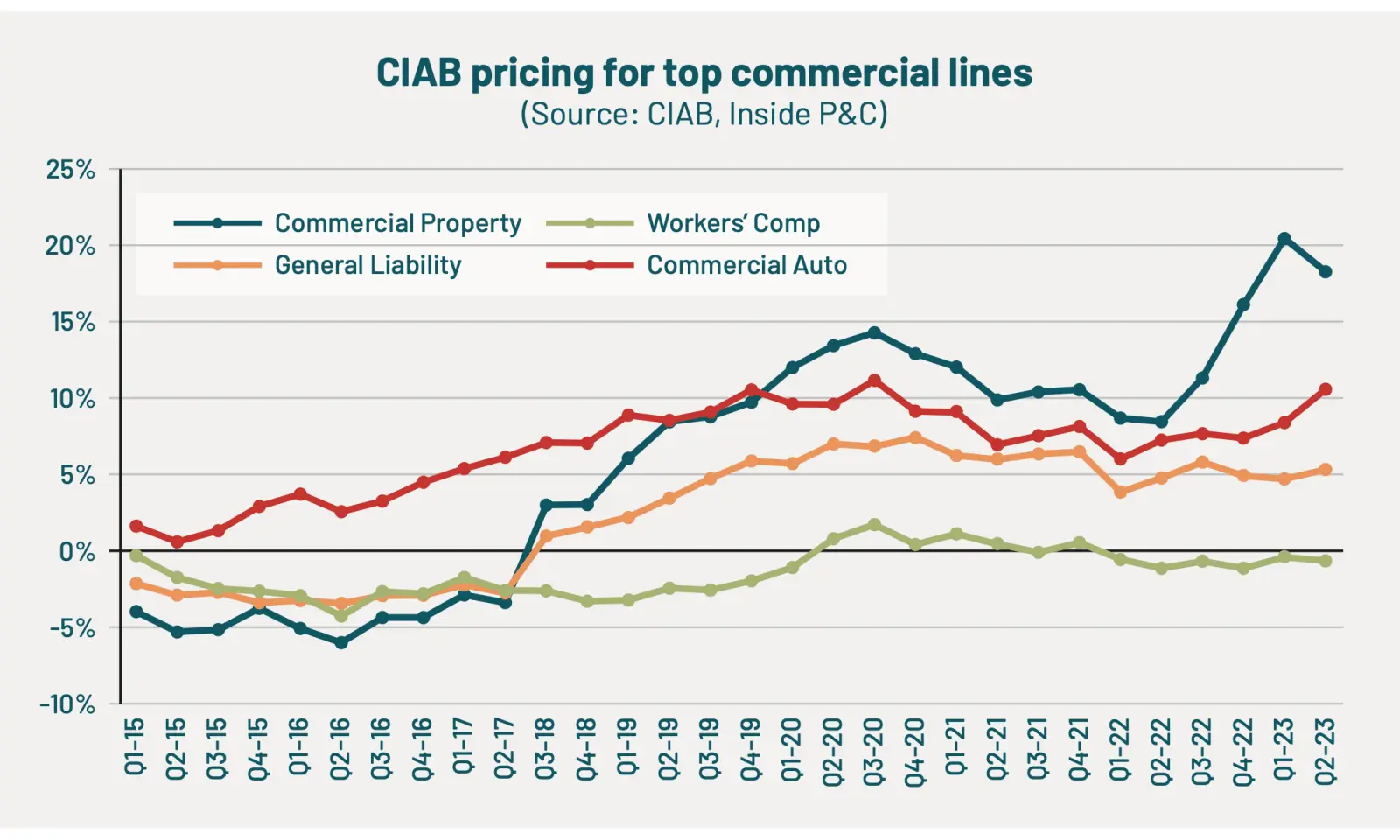

However, rate inflation remains a lagging indicator, with some insurance lines changing course more sluggishly than others.

Spotlight: Key Learnings from Commercial Property and Cyber Rates

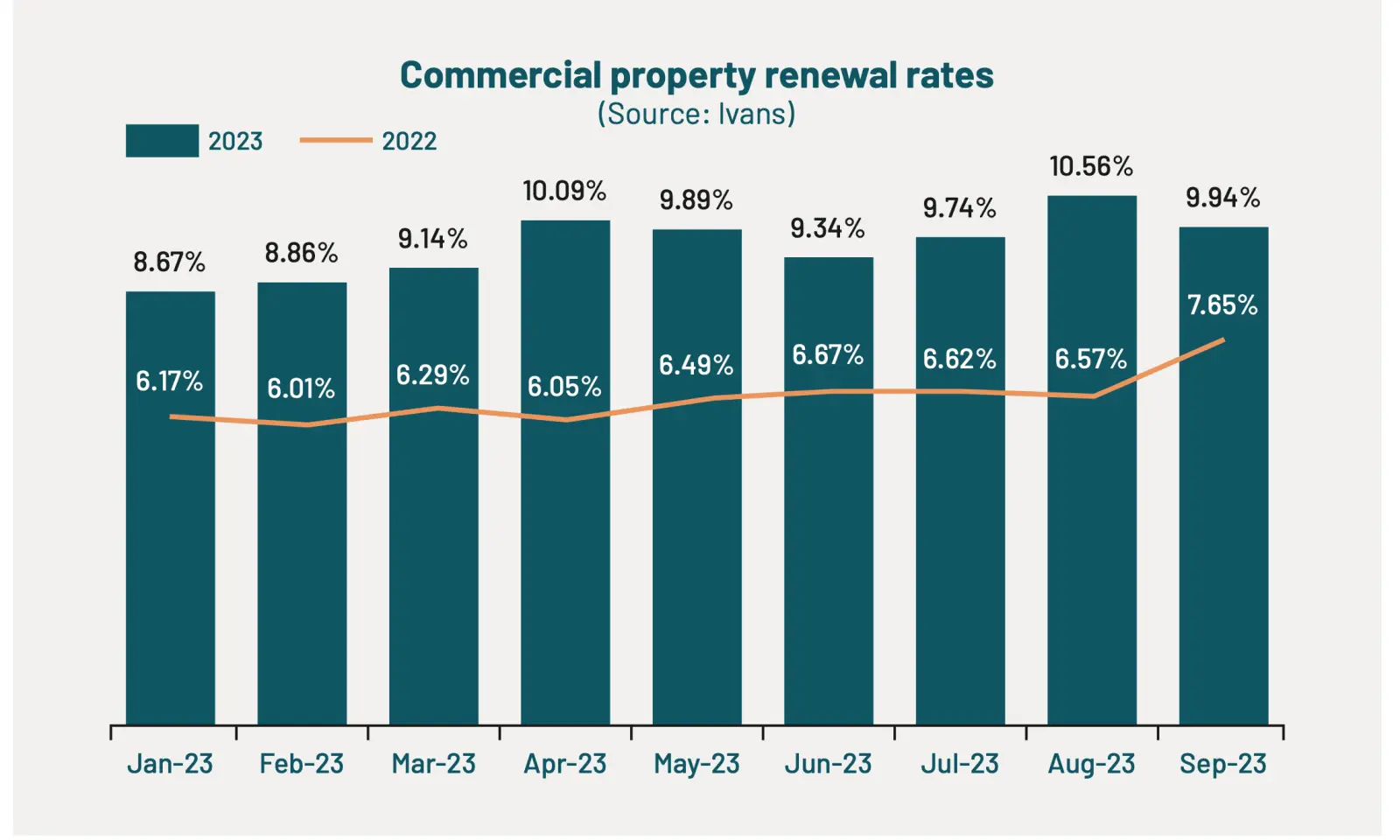

As anticipated in 2023, the commercial insurance sector witnessed a continuation of the seven-year trend of premium renewal rate inflation. Areas such as commercial property insurance rates experienced accelerated growth in 2023, persisting as an outlier among commercial lines with rate inflation near or at double digits in Q3.

This trend is anticipated to persist into 2024, driven by natural catastrophe activity.

One major driver of this trend has been, of course, the surge in natural catastrophes. Even before the end of the third quarter in 2023, the US experienced a record number of billion-dollar “weather and climate” disasters, including extensive flooding, landslides in California, and the deadliest wildfires in over a century in Hawaii.

Elsewhere, major earthquakes in Turkey, Syria, and Morocco, along with unprecedented wildfires across Canada, stressed insurance and reinsurance resources, even as inflation and other economic pressures abated.

Cyber Risk: Navigating the New Frontier

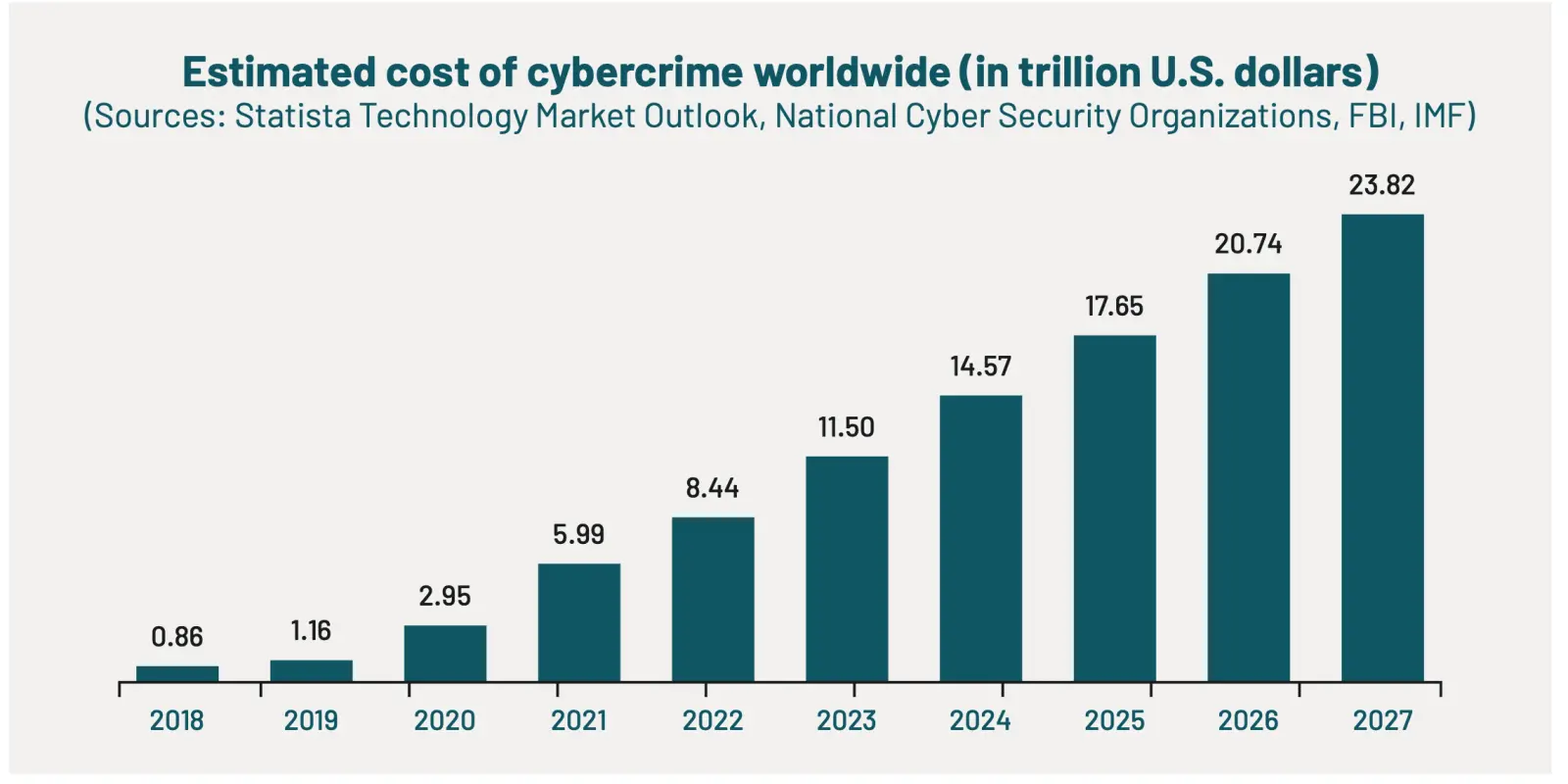

After stabilizing in some areas in 2022, cybercrime damage is expected to surpass $8 trillion for the first time in 2023, with double-digit annual increases projected through the mid-2020s.

Large-scale cyber events, like the MGM Casinos cyberattack, exposed human vulnerabilities as a persistent and growing risk.

At a time when AI-driven technologies are improving efficiency for insurance businesses, cybercriminals are reaping these benefits. Developments such as advancements in quantum computing add complexity to the evolving cyber risk landscape.

As some stand-alone cyber carriers face tests for the first time since entering business during a soft insurance market, a focus on cyber best practices can help control insurance premium outlays, making businesses more “attractive” to insurers in their pursuit of profitability.

In Summary

Here are the key takeaways to remember in reflecting on 2023 trends to inform 2024 outlook:

- The end of 2023 marks a critical juncture for commercial insurance, characterized by rising costs and the anticipation of continued challenges into 2024.

- Despite economic forecasts suggesting a potential softening, uncertainty looms, compelling businesses to brace for higher insurance expenses.

- Remember: "Every crisis is an opportunity" underscores the potential for strategic risk management decisions to shape future outcomes positively.

- As the industry heads into 2024, Poms & Associates envisions a landscape where smart insurance and business risk management become crucial competitive advantages, allowing businesses not only to mitigate insurance costs but also enhance overall resilience.

- The focus on profitability is evident, with a keen eye on emerging risks such as natural catastrophes, cyber threats, social inflation, geopolitical unrest, and economic recovery challenges.

- While stabilized inflation rates and advancements in Insurtech and AI bring a sense of cautious optimism, rate inflation remains a persistent concern.

- The surge in billion-dollar weather and climate disasters in 2023, along with the escalating threat of cybercrime, underscores the evolving landscape that demands businesses to adopt cyber best practices for enhanced attractiveness to insurers amid the pursuit of profitability.

Stay tuned for Part 2, the conclusion of our series, as we explore how businesses can prepare for 2024 and navigate the evolving landscape with proactive risk management strategies.

About Poms Poms brings a new approach to business and personal insurance – one that makes sure you're not just protected against liability, but proactively shielded from risk. We leverage decades of experience and expertise to help you avoid expensive claims, and if those claims do occur, we're prepared to mitigate them. At Poms, we believe knowledge is the best insurance. We believe proactive risk management is a smarter way to insure.

Click HERE to Download Part 1 of 2.